How To Register Punjab Bank Applicaton

Punjab National Bank offers PNB ONE, a unified mobile banking application that brings numerous features under one platform. All major banking operations can now be performed from anywhere and at any time without having to visit the co-operative. The app transactions are made secure through biometric authentication techniques along with MPIN. Know more about how you can admission the service via an app.

How to register for the PNB Mobile Banking services?

Step i: Download and install the PNB Ane app from the Google Play Shop or Apple Store.

Step ii: Open up the app and click on the 'New User' option.

Step iii: Yous will see a screen with instructions about mobile banking. Click on 'Continue'.

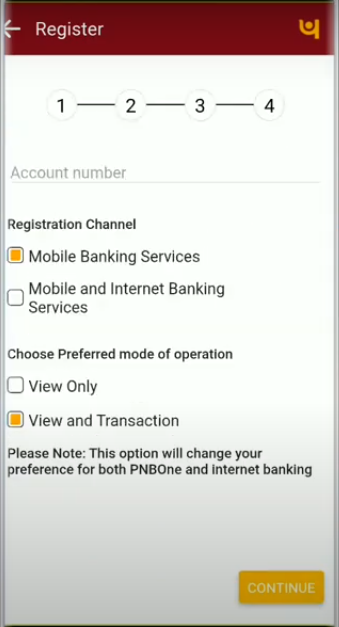

Step 4: In the following screen, enter your account number, cull the registration channel based on your preference, and choose the preferred style of operation. It is brash to cull 'Mobile and Internet Cyberbanking Services' and 'View and Transaction' respectively. Click on 'Continue'.

Step five: An OTP will exist sent to your registered mobile number. Enter the OTP in the designated field and click 'Proceed'.

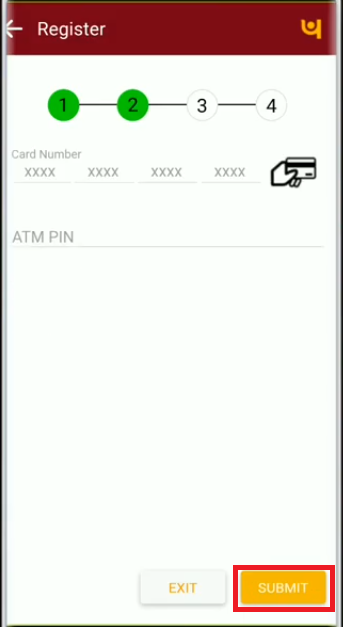

Step 6: Enter the sixteen-digit debit card number and your ATM PIN. Click 'Keep'.

Step 7: You will be prompted to set a sign-in password and transaction password. Yous tin can view the policy related to the password in the option beneath. Once y'all accept confirmed both the passwords, click on 'Submit'. Here, the sign-in countersign is used to log into your account on the mobile banking app. The transaction password is necessary to authorise any money transactions through mobile banking.

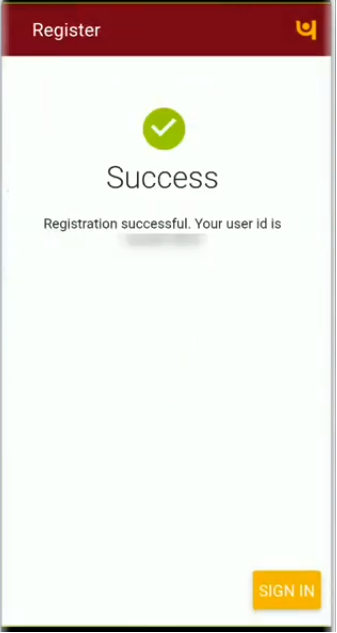

Step 8: You lot will receive a success message on the screen along with your user ID as shown in the image below.

How to fix up MPIN on the PNB Mobile Banking app?

Step one: Open the PNB One app on your smartphone.

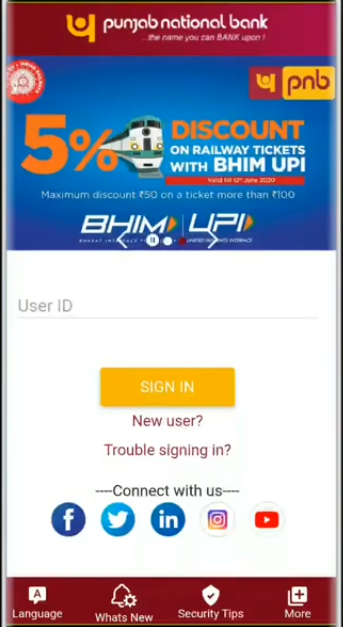

Step 2: Enter your user ID in the space given and click the 'Sign In' push.

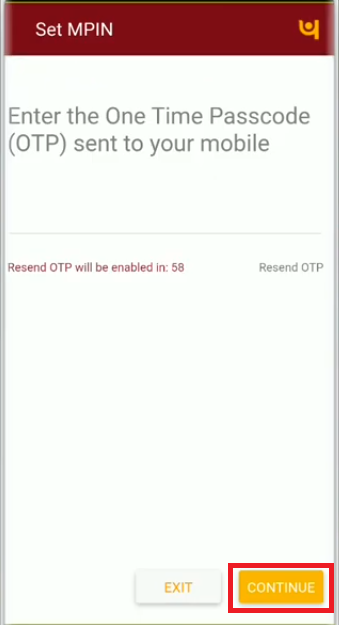

Stride 3: When you try to sign in, an OTP volition be sent to your registered mobile number. Enter the OTP received in the infinite provided and click on 'Continue'.

Step four: You are required to create a 4-digit MPIN to log in to the mobile banking app as an alternative to entering the sign-in password. Click 'Submit' once you confirm the MPIN.

Step five: A success message will be displayed to prove the completion of the registration process.

How to log into the PNB Mobile Banking app?

Step 1: Upon successful registration, you will see a greeting along with your name on the home screen of your app as shown in the image. Enter the 4-digit MPIN in the field. Upon verification, yous volition be redirected to the business relationship'south home folio.

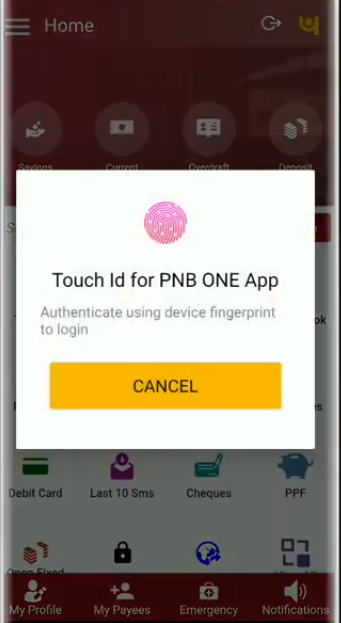

Step ii: On the first login, a pop-up window will appear asking if you would similar to ready up a affect ID. If your mobile has a fingerprint scanner and you wish to fix information technology up, click on 'Aye'.

Step three: Place your finger on the scanner and let the device scan it when the post-obit prompt is displayed.

Step 4: One time the scan is done, yous will see a bulletin 'Authentication Succeeded' at the bottom of the screen. Also, you will be requested to enter the MPIN for confirmation. Now, click on 'Submit'.

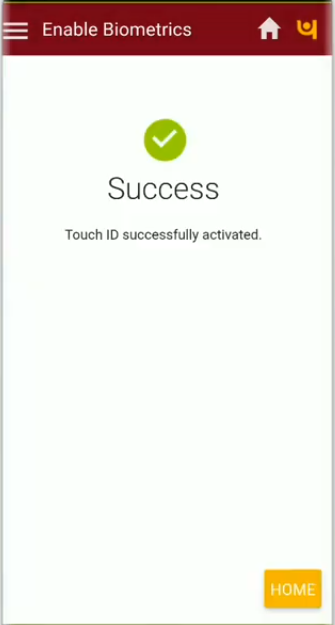

Step 5: You volition run across some other success message for creating Touch ID. Click on 'Home'.

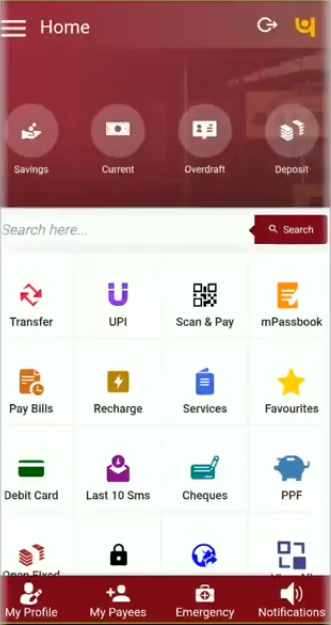

Step 6: Yous volition see the habitation screen of your account with thumbnails related to all the services available.

What are the services offered past the app?

- Access your savings, deposit, loan, overdraft, and credit card accounts.

- View the account statement and check the account residue.

- Brand regular coin transfer to self, accounts within the bank, and accounts outside the banking concern.

- Brand instant or scheduled transfers via NEFT, RTGS, and IMPS.

- Open a term/recurring deposit account online.

- Invest in mutual funds.

- Purchase insurance.

- View contempo transactions; set instructions for recurring payments.

- Apply for a new debit card and update spending limits on the card.

- Make auto-payment registration and de-registration on your credit card.

- Scan and pay using QR code.

- Register and pay utility bills.

How to transfer funds using the PNB Mobile Banking app?

Step 1: Log into your business relationship on the app to run into the domicile screen.

Step two: Click on the 'Transfer' icon in the dashboard.

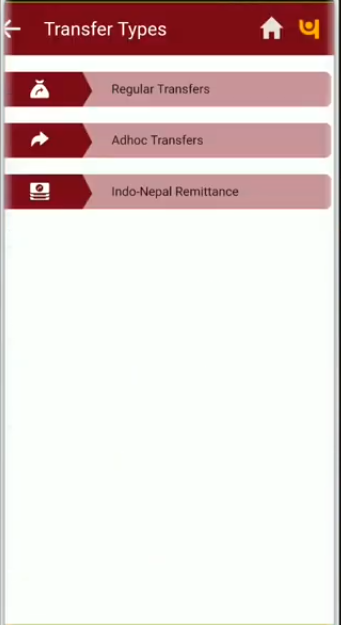

Step 3: You will run into three types of transfers. Select the 'Regular Transfers' option.

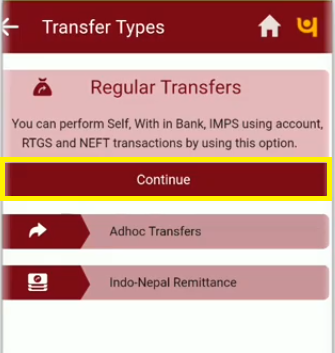

Pace four: You will see a description that says IMPS, RTGS, and NEFT transactions can be done. Click on 'Continue'.

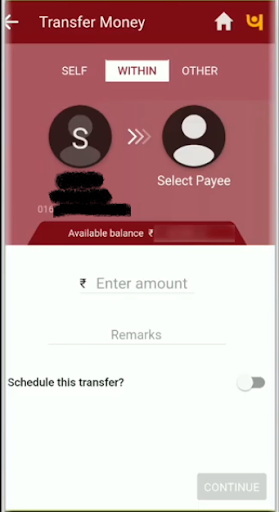

Step 5: You will encounter your name and business relationship number on the left side and 'Select Payee' option on the right.

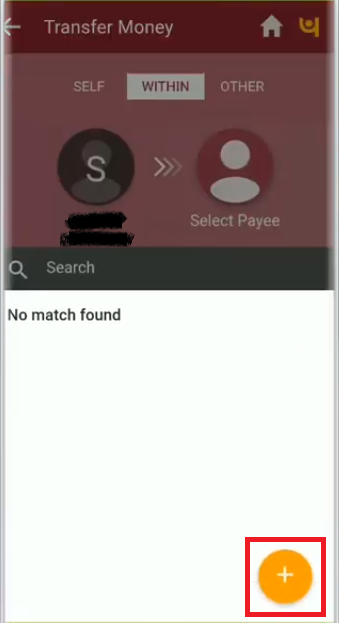

Step 6: You will come across a window sliding up. If the casher is not added yet, click on the '+' button.

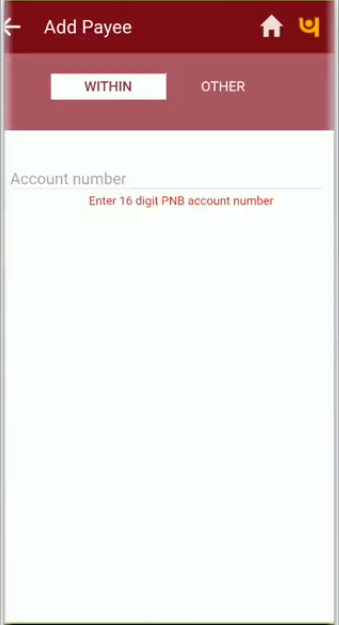

Step 7: Enter the 16-digit beneficiary account number in the field if it is a PNB business relationship.

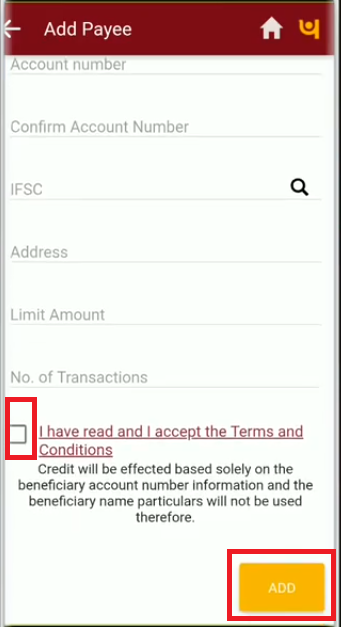

Footstep eight: If the casher account is maintained with any other bank, select the 'Other' option on the top of the screen. Here, you lot have to enter the name, account number, IFSC, accost, and other details to add a beneficiary.

Step 9: Agree to the terms and conditions by selecting the checkbox and click 'Add'.

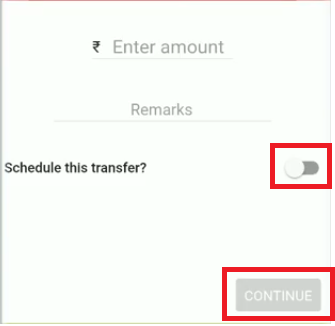

Step ten: Now, select the payee from the list of beneficiaries, enter the amount to be transferred, and add remarks if any. You lot tin can plow ON the button button to schedule the payment for a future engagement. Click on 'Continue'.

Step xi: An OTP will be sent to your registered mobile number. Enter the OTP to authorise the transaction.

Footstep 12: A success bulletin volition exist displayed forth with the details of the transaction, such every bit reference number, payer business relationship, payee business relationship, and the transferred amount.

Frequently Asked Questions

Tin I transfer funds instantly after adding a beneficiary?

No, you can brand a funds transfer to a newly added casher only later on 2 hours on the mobile cyberbanking app.

Tin I set a limit on the amount I tin use on my debit card via PNB 1?

Yous can gear up a limit on the debit bill of fare usage via ATM withdrawal and east-Commerce expenses through PNB One. Merely log into your business relationship, choose the 'Debit Menu' tab, and select 'Update ATM Limit/POS/E-Comm Limit.

I have many accounts with different branches of PNB. Should I annals for mobile cyberbanking separately for each account?

All the accounts opened nether a unmarried customer ID volition exist available past default upon registration for mobile cyberbanking. If you are unable to view any of the accounts, information technology is brash to visit the branch office and become your client ID updated.

How practise I know if I am eligible for mobile banking services?

All retail banking customers with individual and articulation accounts (with operation mode—either or survivor) are eligible to register for mobile banking services.

Related Articles

Citibank Mobile Banking

ICICI Depository financial institution Mobile Cyberbanking

Centrality Bank Mobile Banking

HSBC Bank Mobile Cyberbanking

HDFC Depository financial institution Mobile Cyberbanking

Invest in Straight Mutual Funds

Save taxes upto Rs 46,800, 0% commission

How To Register Punjab Bank Applicaton,

Source: https://cleartax.in/s/pnb-mobile-banking

Posted by: dionplacrour.blogspot.com

0 Response to "How To Register Punjab Bank Applicaton"

Post a Comment